Income Limit For Marketplace Insurance 2024. The budget proposes to permanently extend premium tax credits for health coverage purchased through the health insurance marketplace, which are currently. For 2024, the irs has raised the roth ira contribution limit to $7,000 ($8,000 for people over age 50).

People with higher incomes and certain tax filing statuses might. 2023 filing requirements for dependents under 65:

Is There An Income Limit To Get Marketplace Insurance?

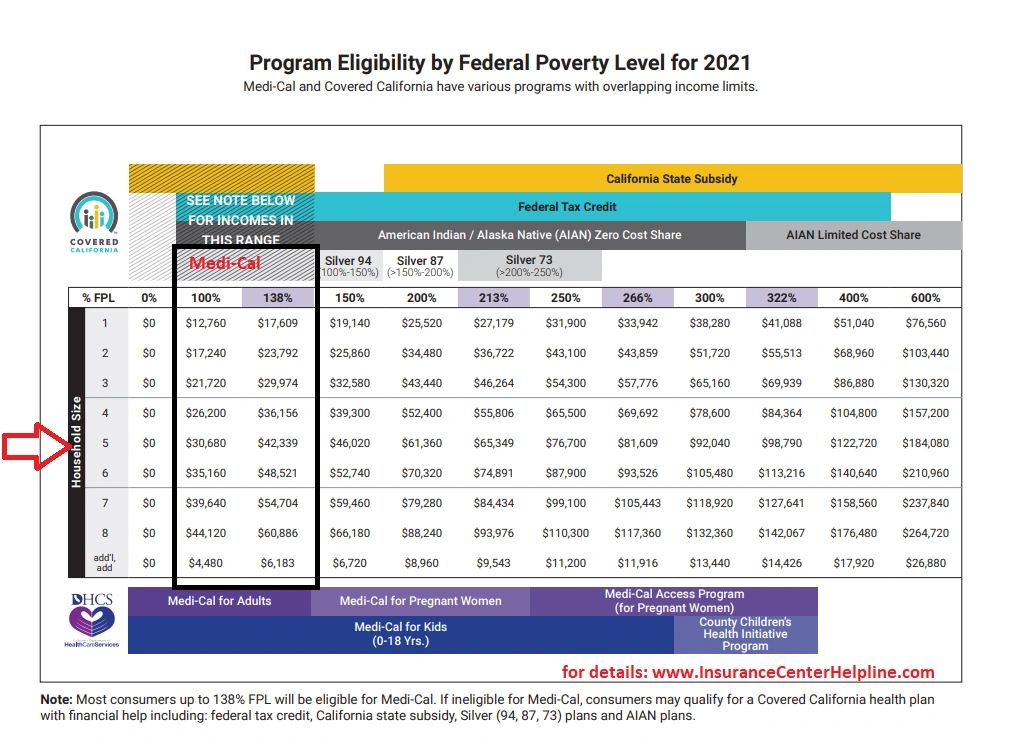

Find marketplace p remiums or see if you may qualify for medicaid or children’s health insurance program (chip) coverage.

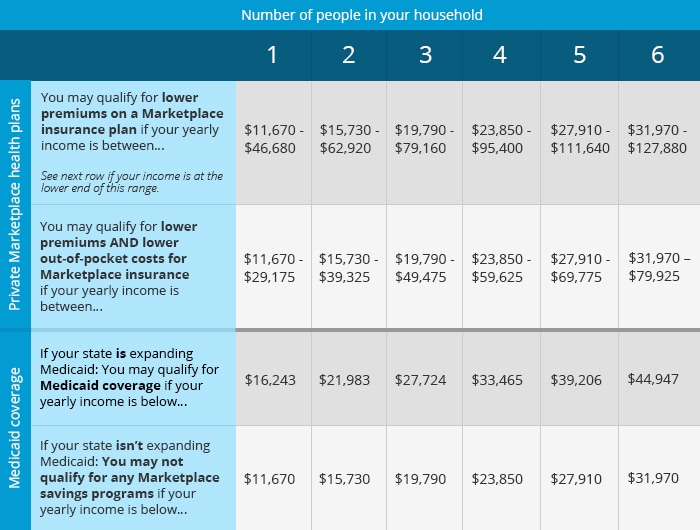

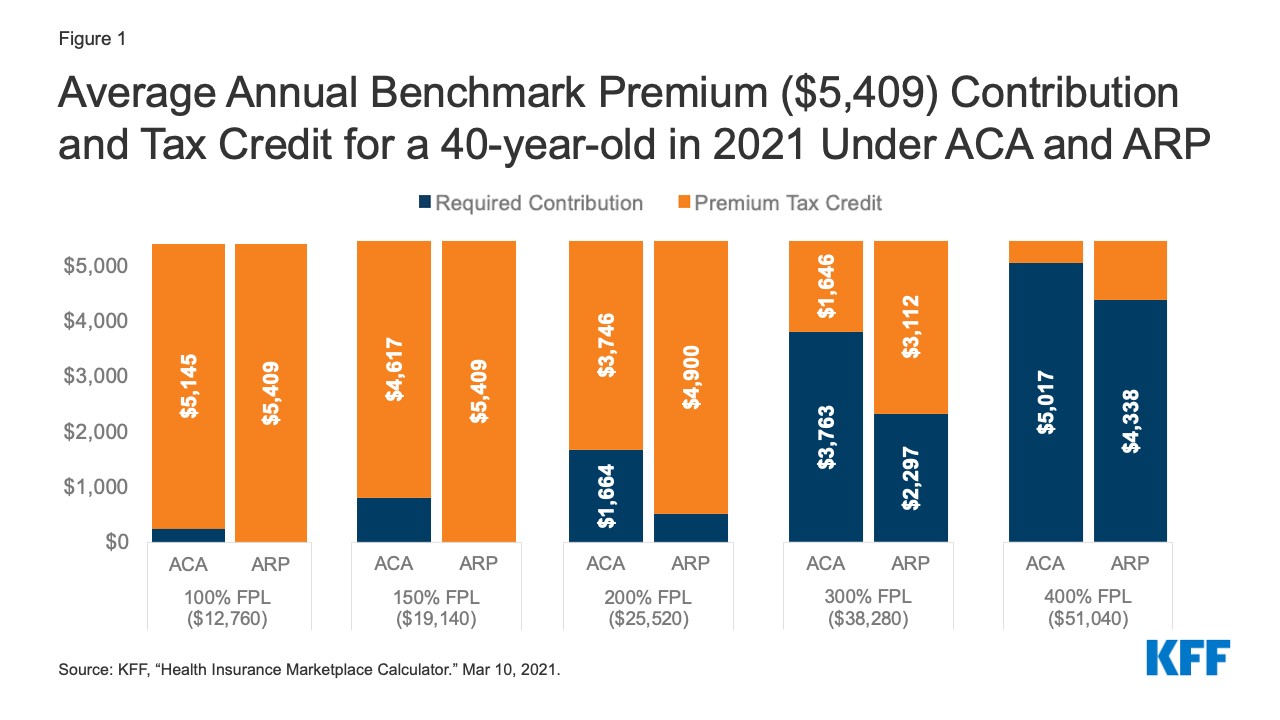

For Most People, Health Insurance Subsidies Are Available If Your Income Is Between 100% And 400% Of The Federal Poverty Level (Fpl).

It depends on how much you earn.

This Expansion Of Coverage Is Estimated To Save New Yorkers An Average Of $4,700 Per Year,.

Check your state marketplace website to see if they give you more time.

Images References :

.jpg) Source: incomearta.blogspot.com

Source: incomearta.blogspot.com

Marketplace Limits 2022, There's another limit related to how you obtain health insurance. This pushes your income to $50,000.

Source: www.healthcare.gov

Source: www.healthcare.gov

Low Cost Marketplace Health Care, Qualifying Levels HealthCare.gov, Open enrollment for 2024 coverage starts november 1! In 2024, marketplace plans cap annual oop spending at $9,450.

Source: tabitomo.info

Source: tabitomo.info

Marketplace Health Insurance 2023 Tabitomo, In 2024, marketplace plans cap annual oop spending at $9,450. One of the easier ways to get more credit is to open a new credit card.

Source: www.coloradowic.gov

Source: www.coloradowic.gov

20232024 Eligibility Guidelines CDPHE WIC, Is there an income limit to get marketplace insurance? Earned income of at least $13,850, or unearned.

Source: www.talktomira.com

Source: www.talktomira.com

Updated Limits and Subsidy for Obamacare in 2024 Mira, Check if you might save on marketplace premiums, or qualify for medicaid or children's health insurance program (chip), based on your income. People with higher incomes and certain tax filing statuses might.

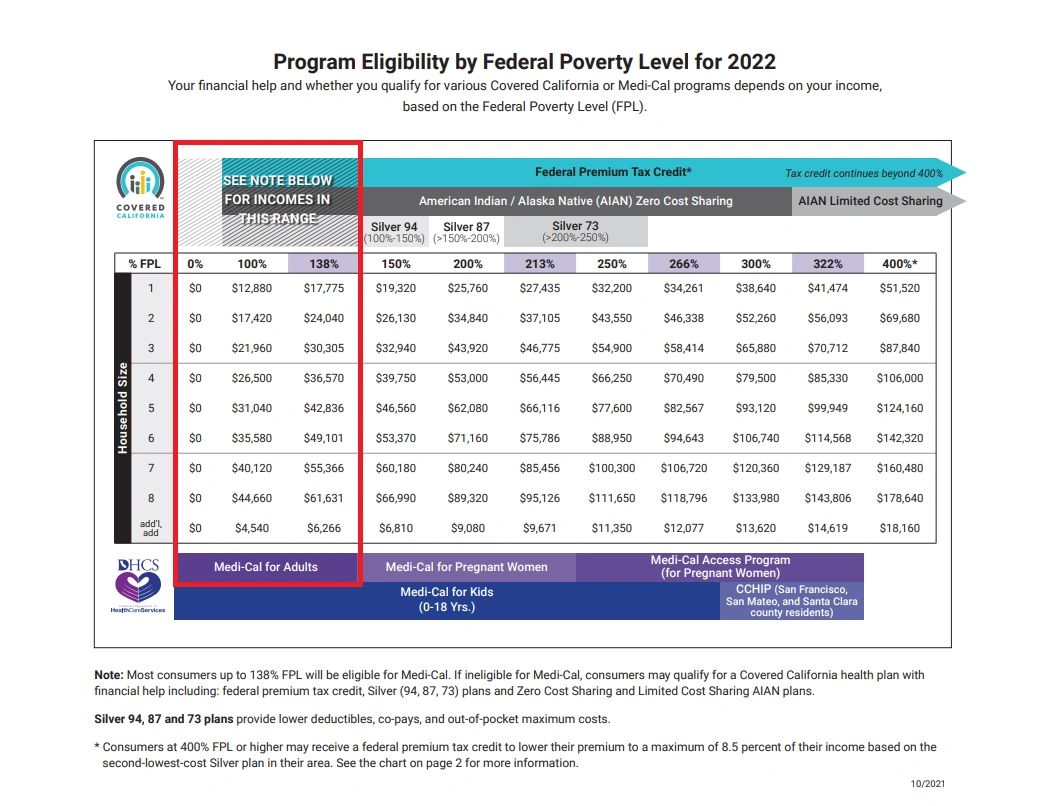

Source: insurancecenterhelpline.com

Source: insurancecenterhelpline.com

Health Insurance Limits for 2022 to receive ACA premium s, Earned income of at least $13,850, or unearned. For 2024, the irs has raised the roth ira contribution limit to $7,000 ($8,000 for people over age 50).

Source: angrybearblog.com

Source: angrybearblog.com

Facts about the ACA marketplace for 2023 Angry Bear, Apply for a new credit card. In this first of three forefront articles on the final 2024 payment rule, we focus on market reforms and consumer assistance.

Source: excelspreadsheetsgroup.com

Source: excelspreadsheetsgroup.com

Health Insurance Marketplace Levels Financial Report, The minimum income requiring a dependent to file a federal tax return. There are also dollar caps on.

Source: excelspreadsheetsgroup.com

Source: excelspreadsheetsgroup.com

Health Insurance Marketplace Chart Financial Report, The table below shows the. This pushes your income to $50,000.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Are The Medicare Limits For 2022, For the 2024 tax year, you must repay the difference between the amount of premium tax credit you received and the amount you were eligible for. Under the aca, plans also have oop spending limits that apply regardless of household income.

Suppose In December 2023 You Decide To Convert $20,000 From A Traditional Ira To A Roth Ira.

2023 filing requirements for dependents under 65:

The Budget Expands The Credit From $2,000 Per Child To $3,000 Per Child For Children Six Years Old And Above, And To $3,600 Per Child For Children Under Six.

Earned income of at least $13,850, or unearned.

This Pushes Your Income To $50,000.

This marketplace subsidy calculator can show you your eligibility for different income amounts and family.